Digital Tenge project: breakthrough in Kazakhstan’s finance system

Kazakhstan is preparing to make waves in the world of digital finance with the plans to introduce the Digital Tenge. This ambitious project, spearheaded by the National Bank of Kazakhstan, aims to modernize the country's financial infrastructure and bring about significant changes for ordinary citizens, the economy, and the financial sector. In this analytical piece, Kazinform delves into the development of the Digital Tenge project, its potential impact on various aspects of the country’s life and expert opinions.

The reasoning behind digital tenge

Addressing the representatives of the financial sector in November 2021 in Almaty, President Kassym-Jomart Tokayev said a digital tenge could become a key element of the future financial system.

Since 2021, the National Bank of Kazakhstan has been implementing the project. The digital tenge will act as the third form of national currency of Kazakhstan, along with cash and non-cash money.

The primary driving force behind the digital tenge lies in its capacity to enhance financial inclusion, foster growth, spur innovation within the payments sector, and bolster the competitive edge of Kazakhstan's financial industry on the international stage.

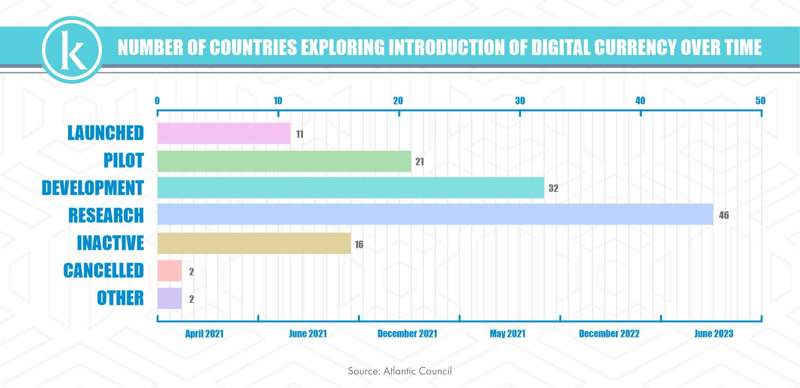

Kazakhstan is not alone on this path. Countries worldwide started considering introducing their own digital currencies, which would combine traditional functions of money with the technological demands of the modern digital economy in a manner that satisfies the interests and needs of all economic participants.

According to expert estimates, 130 countries, representing 98 percent of global GDP, are exploring a digital currency. In May 2020, for example, only 35 countries were considering it.

Eleven nations have successfully introduced a digital currency. China's experimental program, currently accessible to 260 million individuals, is undergoing testing in more than 200 different situations, including public transportation, economic stimulus disbursements, and online commerce.

What is digital tenge?

Kazakh economy has cash and non-cash money. Cash includes banknotes and coins, non-cash – money in bank accounts.

The digital tenge will perform all the functions of classical money for all economic entities. It will be issued in the form of a unique digital sequence (tokens) or electronic records stored in special electronic wallets. It will be under the full jurisdiction of the National Bank.

The national digital currency sets itself apart from cryptocurrencies and other electronic payment systems in several key ways. One significant distinction is that it is backed by the National Bank, ensuring a level of security and accountability that many cryptocurrencies lack.

“For instance, in the event of account loss or similar issues, the digital tenge offers recovery options, a feature unavailable with many cryptocurrencies,” Ainur Kenzhayeva, head of Research and Development (R&D) at the Digital Tenge project, told Kazinform.

Another important feature is its programmability through smart contracts and its tokenized structure. This sets the digital currency apart from traditional currencies, enabling the creation of innovative services and products more easily, quickly, and cost-effectively than existing electronic payment systems allow.

With the introduction of the digital tenge, both cash and non-cash money in Kazakhstan will continue to be in circulation. The digital currency will coexist alongside them, offering a modern and efficient alternative.

However, the development and implementation of legal regulation of the digital tenge requires a thorough examination and can be implemented after evaluating the outcomes of the pilot operation involving all participants on the digital tenge platform.

Phased implementation

In 2022, the nation made a decision on the phased introduction of digital tenge in three phases until the end of 2025. According to the roadmap of the project, the first stage will be implemented in 2023, covering two areas - creating industrial and experimental environments of digital tenge platforms and pilot operation.

Within the pilot operation, basic scenarios of using the digital tenge as a means of payment are being tested, including integration with financial market participants and financial infrastructure providers. The mechanism of programmable payments using smart contracts is also being introduced.

The research part includes testing of cross-border settlements in digital currencies of central banks, interaction with participants of the digital asset market, and consideration of the possibilities of using the digital tenge as a settlement infrastructure for tokenized assets.

“In 2021, the National Bank successfully conducted the first stage of the project, proof-of-concept, to explore the possibilities of introducing the digital tenge in Kazakhstan. Since the beginning of the project, a prototype digital tenge platform has been developed to test the viability of the concept, an initial model for assessing the impact of the digital tenge on the economy, financial stability and monetary policy has been developed, and possible regulatory approaches have been identified,” said Kenzhayeva.

In 2022, the National Bank continued examining the potential benefits and drawbacks of introducing the digital tenge, a move that could significantly impact various stakeholders, the payment system, financial stability, and the economy as a whole.

A crucial step in the project occurred in July 2022 when the Decision Model for its implementation was published. This model considered international experiences, economic and regulatory studies, technological factors, consumer behavior, project sessions, and expert input, including recommendations from international organizations. An advisory council was formed comprising experts from the International Monetary Fund, the Bank for International Settlements, and the World Economic Forum.

In October 2022, successful tests were conducted on the digital tenge technology platform involving real consumers, trade, and service businesses. This testing covered the entire life cycle of the digital tenge, including issuance, redemption, integration with market players, and the ability to program targeted payments. It also demonstrated secure transactions without internet access.

Economic modeling confirmed that the introduction of the digital tenge would not jeopardize monetary policy or financial stability, said Kenzhayeva.

The results of the pilot operation will be presented to President Tokayev at the Congress of Financiers in November in Almaty.

User experience

Kenzhayeva explained one of the main requirements during the development of the digital currency was to maintain a familiar user experience.

“The two-tier architecture for interacting with the financial market implies preserving the role of second-tier banks. Therefore, for end-users, using the digital tenge will not be significantly different from using non-cash methods,” she said.

Access will be provided through mobile applications with the option to make payments using QR codes or other means.

“Work is also underway to create a bank card based on the digital tenge. Traditional transaction methods will remain available, but there will also be a fundamentally new payment solution - offline payments, meaning you can pay with your mobile phone without an internet connection,” said Kenzhayeva.

Potential impact

One of the primary objectives of the digital tenge is to improve financial inclusion by making it easier for people, including those in remote areas, to access financial services through their smartphones.

In the future, the introduction of Digital Tenge will increase the efficiency of cross-border payments.

“The potential introduction of the digital tenge has the potential to accelerate economic activity by enabling instant and cost-effective payments, particularly beneficial for cross-border transactions and transfers. This will be made possible through a high level of functional compatibility among digital currencies from central banks of different countries,” Kenzhayeva explained.

Simultaneously, the technological feature of the digital tenge, allowing for the marking and tracking of individual tokens, will enhance transparency and efficiency in government-involved payments, thereby positively impacting the economy of Kazakhstan.

In its report, the National Bank noted the transactions can be conducted completely anonymously. Addressing potential safety concerns, the National Bank said it takes a balanced approach between ensuring the anonymity of transactions and countering fraud and money laundering. The platform will feature a managed anonymity approach, in which the degree of anonymity depends on the risk level of the transaction according to a set of criteria.

Additionally, work is underway to minimize other cybersecurity risks related to countering the threats of double spending of digital tenge tokens, uninterrupted and safe operation in offline mode.

Kenzhayeva emphasized that the positive impact of introducing the digital tenge on the economy will primarily depend on its level of adoption by the population and businesses. In a survey conducted in 2022, approximately 60 percent of respondents expressed readiness to use the digital tenge in their daily transactions.

Experts’ opinion

According to Kazakh economist Arman Baiganov, digital currency can completely replace cash.

“The issue of digital tenge will be the same as cash - in limited quantities by the National Bank and will depend on the state of the economy. The control system will be electronic. People will have electronic wallets. It will be possible to make payments, transfers and see the balance using electronic money,” Baiganov told Kazinform.

According to him, the use of digital tenge has enormous benefits for the national economy.

“Firstly, the state will not have such emissions costs. The state bears very high costs for emissions. This is a banknote yard, a mint, collection, security - these are very large expenses and a huge staff of people. The issue of digital tenge does not require such costs, because it happens online. In a word, the introduction of digital currency means saving budget funds,” the expert noted.

He also said the introduction of digital currency may help address problems in fiscal policy, the shadow economy and corruption.

“Here it will be difficult not to pay taxes, tax authorities will be able to check online who has not paid taxes, by the end of the year their debits and credits will not match and people will be afraid of not paying and all these problems will remain a thing of the past,” he said.

“Everything will be online and the tenders will be transparent. Business will compete on equal terms, without protectionism, without connections and corruption. This will develop business,” said Baiganov, expressing big optimism.

Baiganov said with any initiative that is novel as digital tenge, there are always risks.

“If it is digital, there will be different cyberspaces, hackers,” he added.

Overall, the Digital Tenge project has the potential to have a positive impact on ordinary citizens, the economy, and finance in Kazakhstan. But whether it becomes a breakthrough in the financial system will only be seen in the next few years.