Kazakhstan’s total FDI reaches $402 billion as new investment measures come into effect

Abundant natural resources, a stable political climate, and a strategic location have been among the key factors helping Kazakhstan, a rising economic powerhouse in Central Asia, attract global investors since its independence. Yet, the changing geopolitical landscape makes it more challenging for Kazakhstan to continue these efforts. More about the key trends in the foreign direct investment (FDI) flows in the country in 2023, how the geopolitical developments shape the work, and what stands next is in the latest article of Kazinform News Agency.

A snapshot of the current state of FDI in Kazakhstan

In a recent study published by fDi, which assesses the macroeconomic and FDI trajectories of the world’s top 50 FDI destinations, Kazakhstan was ranked sixth.

The FDI Standouts Watchlist 2024, which outlines countries with the strongest investment momentum into 2024, is compiled by fDi Intelligence, a division of Financial Times, a bi-monthly news and foreign direct investment publication, providing an up-to-date review of global investment activity.

The report “singles out those countries that are entering the new year with a strong macroeconomic and FDI momentum as the world continues to grapple with a patchy post-COVID recovery.”

Asia has shown strong performance in the current year's watchlist, with six countries ranking in the top 10. Cambodia holds the leading position, followed by the Philippines in second, Iraq in fourth, Kazakhstan in sixth, Azerbaijan in seventh, and India in tenth. Only three African nations have secured spots in the top 10: Kenya in third, Namibia in fifth, and Morocco in eighth. Serbia, as the sole representative outside Asia and Africa, claimed the ninth position in the rankings.

The report suggests investors “should keep track of these markets and the opportunities they may offer.”

Overall, the gross FDI inflows to Kazakhstan from 2005 to the first nine months of 2023 amounted to $402.7 billion, said Chingiz Ibragimov, Deputy Director of the Department of Strategy and Digital Development at Kazakh Invest national company, in an interview with Kazinform.

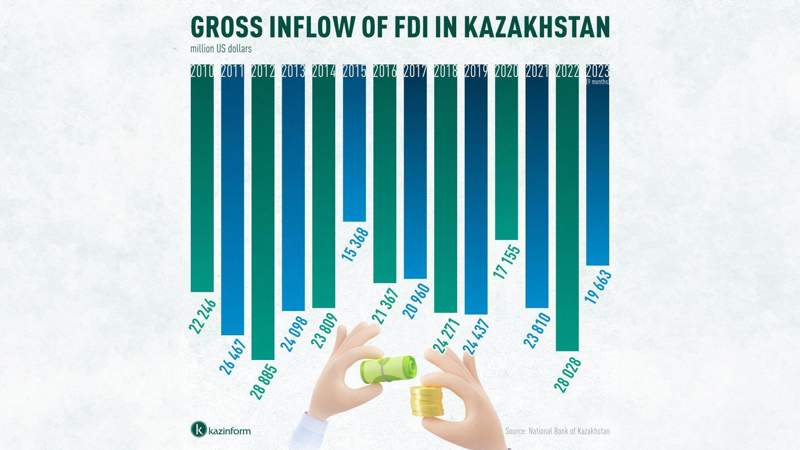

Data shows that Kazakhstan's economic landscape has seen a dynamic ebb and flow in FDI since 2010. Starting at $22.2 billion in 2010, FDI steadily climbed, reaching its peak at 28.8 billion in 2012, data from the National Bank of Kazakhstan shows. The subsequent years witnessed fluctuations, with notable dips in 2015 and 2019.

Despite challenges, the Kazakh economy displayed resilience, attracting renewed investor confidence. By 2021, FDI rebounded to $23.8 billion, showcasing a positive trend. As of the first nine months of 2023, FDI stands at $19.7 billion.

Kazakhstan set an ambitious goal to attract $150 billion in FDI by 2029 under its National Investment Policy.

In an interview with a local TV channel in December, Kazakh Prime Minister Alikhan Smailov said they expect the FDI figure for 2023 to be approximately $27 billion, which is also “quite a high figure.”

"Much of this has become possible thanks to the delicate diplomacy of our President, who, in the face of complex geopolitical tensions, consistently strengthens relations with a wide range of major players. These include China, Europe, Russia, the United States, Türkiye, the Arab world, and others," said Smailov.

Ibragimov mentioned the report of the United Nations Conference on Trade and Development (UNCTAD), which indicated Kazakhstan demonstrated an 83 percent growth in net FDI, reaching $6.1 billion.

“It entered the top 50 countries in the world for FDI inflows, becoming a leader among transit economies, among the 15 post-Soviet countries, and among the 32 landlocked developing countries. Along with that, there's been a noticeable uptick in investments flowing into the manufacturing sector. Specifically, the manufacturing industry accounted for 20 percent of total investments last year, a notable jump from the previous cap of 10 percent. In contrast, the mining sector's contribution dwindled from 70 percent down to 43 percent by 2022,” he explained.

What sectors are most attractive to investors?

The mining and quarry development sector has attracted most of the FDI in Kazakhstan in recent years. In 2020, the mining and quarry development sector attracted a noteworthy $8.2 billion in FDI and rose to $9.7 billion in 2021. The sector continued to attract more investments in 2022 and 2023 (9 months) - $12.1 billion and $8.6 billion, respectively.

Overall, according to Ibragimov, the mining industry takes a 35.3 percent share in the total volume of FDI inflows, followed by professional, scientific, and technical activities – 22.6 percent; manufacturing industry – 15 percent; trade – 11.5 percent, and financial and insurance activities – 4.7 percent.

This data still shows that much of the investments go to traditional industries, though Kazakhstan seeks to attract more in non-resource-based sectors like renewables and deep processing.

Breaking down into the sectors, $6.7 billion out of $8.6 billion invested in the mining sector in 2023 was invested in the extraction of crude oil and natural gas. Investments in this sector are traditionally the highest and continue to grow. In 2022, they reached $9.6 billion, up from $6.6 billion in 2021.

The manufacturing industry is the second most attractive sector. In 2022, it attracted $5.4 billion, and in the first nine months of 2023, it attracted $3.9 billion.

In 2022, the wholesale and retail trade and repair of cars and motorcycles sector witnessed a remarkable surge, reaching $5.25 billion in FDI from $3.7 billion in 2021. In the nine months of 2023, it attracted $3.8 billion.

The transportation and storage sector also attracted considerable investments, with $1.2 billion in 2022 and $855 million in 2023. Financial and insurance services received $651 million in 2022 and $725 million in 2023.

Who are the biggest investors in Kazakhstan?

The Netherlands is a leading foreign investor in Kazakhstan and remained so for many years. According to the data from the National Bank of Kazakhstan, in the first nine months of 2023, Dutch investments in Kazakhstan made $4.57 billion. In 2022, the Netherlands invested $8.3 billion in Kazakhstan, the highest since 2012.

Over the past 10 years, direct investment totaled nearly $82 billion. Besides being the largest investor, the Netherlands is one of Kazakhstan's largest trading partners. From January to October 2023, 5.7 percent of Kazakh exports went to the Netherlands, data from the Bureau of National Statistics shows. More than 900 companies with Dutch capital work in Kazakhstan.

The second biggest investor in the Kazakh economy is the United States. In 2023, American investments reached $3.1 billion, and in 2022, they reached $5.1 billion. They made a notable growth from just $2.8 billion in 2021 and $2.2 billion in 2020. The latest high-level visits, including by United States State Secretary Antony Blinken in February 2023 and President Kassym-Jomart Tokayev’s visit to New York in September 2023, where he met with top American executives, facilitate trade and investments with American partners.

Switzerland closes the top three foreign investors in Kazakhstan, with $1.9 billion of investments in nine months of 2023. In 2022, they hit $2.7 billion.

Ibragimov noted that in terms of volume breakdown by country, the Netherlands accounted for 29.2 percent, the United States – 13.7 percent, Switzerland – 8.6 percent, China – 6.1 percent, and Russia – 5.2 percent. France accounts for 4.7 percent, and the United Kingdom, 4.3 percent.

“Other significant investors are Belgium, South Korea, Japan, Italy, and Germany,” said Ibragimov.

Latest government measures

Besides Kazakhstan’s rich deposits of oil, gas, minerals, and metals, which makes it a lucrative destination for resource-extraction industries, the nation also offers unprecedented conditions for foreign investors, including tax incentives, streamlined procedures for obtaining permits and licenses, and support for technology transfer and innovation.

There are also 14 special economic zones in Kazakhstan, each with a different industry focus,

where a special legal regime is in place, along with all necessary infrastructure, for conducting activities in priority sectors.

A strategic investment agreement is also another mechanism to support investors, adopted in 2021. The agreement is concluded between the government of Kazakhstan and the legal entity. It provides for the stability of legislation for a period of 25 years, with a special focus on the norms of tax and labor legislation. However, to become eligible for this type of support, an investor should make an investment of not less than $51 million.

Kazakhstan has implemented measures to streamline the processes involved in initiating and managing businesses. A significant portion of these procedures is now accessible through online platforms. Businesses can complete their registration online using the unified government website, reflecting the country's commitment to facilitating a more efficient and accessible business environment.

In December, President Kassym-Jomart Tokayev signed a decree that increases the powers of the country’s Investment Promotion Council.

Chingiz Ibragimov said the recent structural change of the Investment Promotion Council in Kazakhstan marks a significant shift in the nation's approach to attracting foreign investments.

“Under the new decree signed by the President, the council has been empowered with increased authority, particularly in accelerating the implementation of various projects aimed at boosting the country's economy. What this means in simpler terms is that the heads of both central and local executive bodies now bear the responsibility for achieving tangible results in attracting investments through the framework of the council. The oversight of the Investment Promotion Council's operations now falls under the guidance of the First Deputy Prime Minister, Roman Sklyar,” he explained.

Ibragimov acknowledged there were systemic problems that hindered the implementation of projects.

“Difficulties began at the stage of project implementation when the local authorities needed to allocate land plots in special economic zones and provide the required infrastructure and technical conditions,” said Ibragimov.

In the past, the decisions made by the headquarters were merely recommendations. With the recent reform, these decisions will carry the status of mandatory implementation.

“This overall reform is anticipated to accelerate project implementation processes and minimize the procedural steps for investors,” he said, noting that the envisaged three-year tax exemption for new investment projects in the manufacturing sector is expected to advance this progress further.

Challenges

The efforts are notable but were often hindered by geopolitical developments. Considering Kazakhstan's extensive economic connections with Russia due to its long border, the impact of Russian actions in Ukraine, coupled with Western sanctions against Russia, is certainly influencing Kazakhstan's investment environment.

But it may work two ways - it may discourage certain investors from engaging in Kazakhstan. In contrast, others might perceive Kazakhstan as an appealing alternative for conducting business, particularly amid challenges in Russia or Belarus. On top of that, Kazakhstan has consistently demonstrated its commitment to align with Western sanctions against Russia and not to be used for its evasion.

Ibragimov also highlighted that because of many geopolitical factors worldwide, including regional conflicts, there has been a significant increase in the role of transcontinental routes, critical minerals, and other strategic raw materials.

“Kazakhstan’s location in the center of Eurasia and sizeable natural resource reserves, as well as the potential for developing renewable energy, come to the fore. In this regard, there is increased interest from European and Asian partners as the neighboring markets become unavailable,” he said.

Relocation of foreign companies to Kazakhstan

Regarding the relocation of foreign companies from Russia to Kazakhstan, Ibragimov said there was an influx of investors looking to open their production in Kazakhstan.

“We began work on relocating companies to Kazakhstan in April 2022 and continue to this day. We conducted an in-depth analysis and compiled a list of large companies from 38 countries in priority sectors of the economy. Our focus is mainly on manufacturing enterprises and not on brands,” he said.

Decisions were made on 80 companies, 41 of which have already completed this process in 2022-2023, and the rest are being studied. The total cost of the projects reached nearly $1.5 billion.

“For example, the Wabtec Company relocated its regional office and began implementing a project to produce locomotives and components. Microsoft Corporation opened multi-regional hubs in Kazakhstan, Wika launched equipment production for the oil and gas industry, and Honeywell moved its regional office to Almaty and opened production facilities in several regions of Kazakhstan,” he said.

Challenges or risks faced by foreign investors in Kazakhstan in 2024

Ibragimov said that the Kazakh government identified several issues in the risk assessment for foreign investors.

“Firstly, there is a lack of overall development strategy for industries and regions. To elaborate, the work in attracting investments to the region does not correlate with the specific needs of the region in question. This issue will be tackled with the bottom-up development of regional clusters, region-specific investment programs, investment and subsidy targeting and prioritization in financing,” he explained.

Secondly, there is a lack of infrastructure, transparency in the plot allocation process and difficulties in meeting technical requirements.

“These issues will be solved with the lift of industry-specific limitations, expertise-based leadership, further promotion of Industrial Zones, tax reform, and the previously mentioned Promotion Council initiative,” he noted.

According to him, the main risks are observed with the practical implementation of projects, specifically in the allocation of land plots, provision of technical conditions and necessary engineering and communication infrastructure, access to raw materials, weak gasification in several regions, shortage of electric power, and lack of storage facilities.

He is optimistic that the new policies will address these issues, including other bureaucratic problems, such as obtaining financing and subsidies from development institutions and the need for continuity of decisions during the structural reassignments.