Uncovering growth and potential of foreign direct investments in Kazakhstan: a comprehensive analysis

Over the past decade, Kazakhstan has made significant progress in modernizing its economy and opening up to foreign investment. The country's government has implemented several economic reforms to attract foreign investments and boost the country's economic growth. These reforms have included the creation of special economic zones, the introduction of tax incentives for foreign investors, and the simplification of bureaucratic procedures for foreign companies.

In his address to the first session of the Kazakh Parliament of the eighth convocation, President Kassym-Jomart Tokayev said the government is facing the task of attracting significant investment in key sectors of the economy, including foreign investment.

«They should give a tangible boost to the development of medium-sized businesses. There should be no red tape in this matter,» he said.

What makes Kazakhstan an attractive investment destination?

One of the main drivers of foreign investment in Kazakhstan has been the country's rich natural resources. Kazakhstan is home to some of the largest reserves of oil, gas, and minerals in the world. The country's oil and gas sector, in particular, has been a major attraction for foreign investors, with companies from around the world investing in the country's oil and gas fields. Besides oil and gas, Kazakhstan is also rich in minerals such as copper, gold, and uranium, which have also attracted significant foreign investment.

Located in the heart of the Eurasian continent, through which the Great Silk Road once passed, the country’s strategic location remains one of key pool factors for investor, giving access to the regional market of more than 500 million consumers and the common market of the Eurasian Economic Union with more than 180 million consumers. time-efficient transport of goods.

Kazakhstan also plays a key role in the Belt and Road initiative with more than 3,000 of the 10,000 kilometers in total running through Kazakhstan, making it an important section of the main land corridor and significantly reducing transportation time and costs. The nation is also developing its seaport infrastructure at the Aktau and Kuryk sea ports located in western Kazakhstan.

Another factor that has contributed to Kazakhstan's attractiveness as an investment destination is its stable political climate. The country's government has worked hard to maintain political stability, which has helped to create a favorable business environment. The government has also worked to strengthen its legal and regulatory framework, which has further enhanced investor confidence in the country.

Kazakhstan's business-friendly environment has also been a significant factor in attracting foreign investors. The country's government has made it easier for foreign companies to do business in Kazakhstan by simplifying bureaucratic procedures and introducing tax incentives.

How many foreign investments did Kazakh economy receive in 2022?

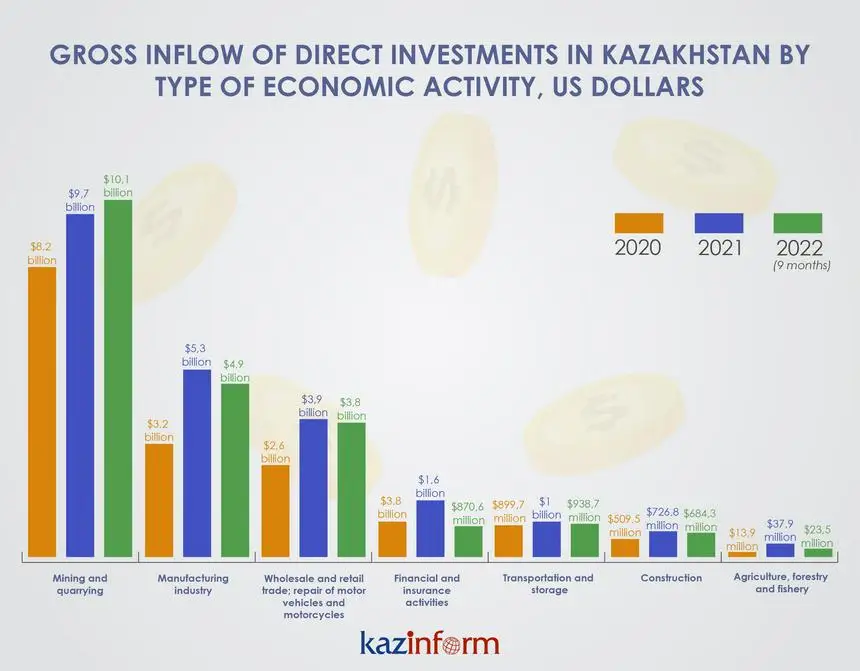

In nine months of 2022, gross FDI in Kazakhstan reached $22.1 billion, up by 17.8 percent or $3.3 billion compared to the same period in 2021.

In terms of industries, the largest share of gross FDI inflows is in the mining industry - 45.7 percent or $10.1 billion, and $8.3 billion or 82 percent of these was invested in the extraction of crude oil and natural gas. Investments in this sector are traditionally the highest and continue to grow. In 2021, they reached $9.7 billion, up from $8.2 billion in 2020.

Among other top sectors in terms of investment are manufacturing ($4.9 billion or 22.3 percent) and wholesale and retail trade ($3.8 billion or 17.1 percent). Investments in manufacturing has already surpassed last year’s indicators, as in nine months of 2021, they stood at $3.6 billion.

The smallest share of gross FDI inflows is in water supply ($16.4 million) and accommodation and catering services ($17.5 million).

Looking at the data, it becomes evident that the structure of FDI by industry remains the same with oil and gas production, metallurgical production and wholesale and retail trade leading.

Kazakh financial analyst Rasul Rysmambetov said agriculture and logistics are promising areas for investment.

«The most attractive sectors for investment today are agriculture, provided that the issue of land allocation and electricity in the long term is resolved, and, most importantly, the issue of water. The second attractive direction for investment, within agriculture, is logistics. Logistics is very important - any projects which improve intra-Kazakhstan inter-regional trade,» said the expert.

«Since we border with such states as Iran, China, we would be interested in producing food products. Even though these two countries provide themselves with enough food, there is plenty of room for our goods there anyway. Investments should also be made to replenish the domestic market, so that we can prepare everything for ourselves,» he explained.

Netherlands is leading foreign investor

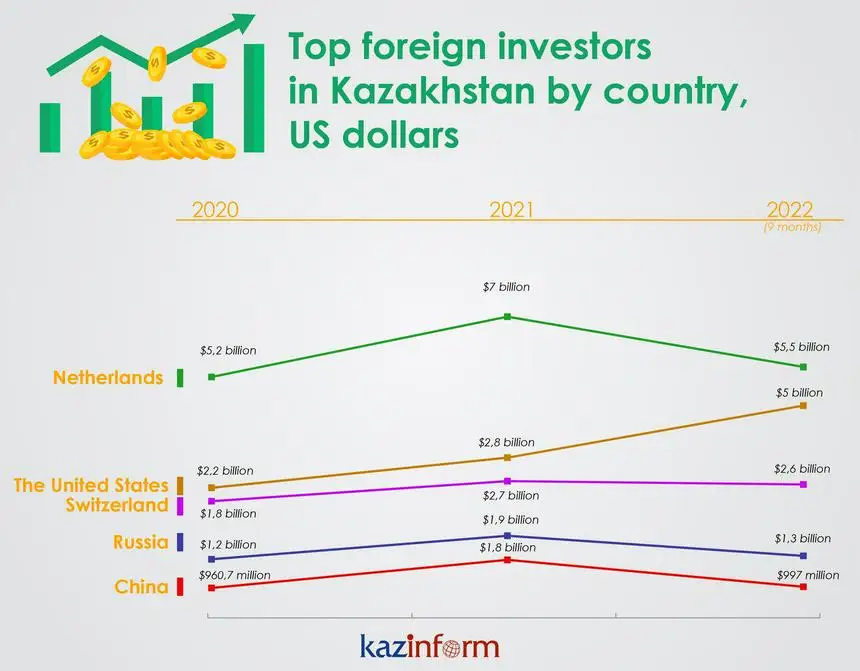

The Netherlands has remained a leading foreign investor in Kazakhstan for many years. In 2022, the Dutch investments in Kazakhstan made $5.5 billion, with the highest recorded in 2021 at $8.9 billion.

Over the past 30 years, direct investment totaled nearly $110 billion. Besides being the largest investor, the Netherlands is one of the five largest trading partners of Kazakhstan. More than 900 companies with Dutch capital work in Kazakhstan.

The Dutch investments in Kazakhstan were at the focus of a Kazakh-Dutch investment roundtable in February 2023 in the World Horti Center in Naldwijk with the participation of officials and representatives of the business community. At the end of the event, bilateral documents were signed between MJ Tech and the Union of Greenhouses of Kazakhstan to implementing the irrigation equipment production project, between Royal GD, a leading Dutch organization in animal health and animal production, and the National Veterinary Laboratory of the Kazakh Ministry of Agriculture and a trilateral memorandum between Karaganda Agricultural Research Station, Kazakh Research Institute of Soil Science and Agrochemistry and Royal Eijkelkamp of the Netherlands.

The sides also agreed to form a list of investment projects with the participation of Dutch companies for their further financing in terms of export and project financing support by the government of the Netherlands.

The second biggest investor in the Kazakh economy is the United States. In 2022, American investments reached $5 billion. They made a notable growth from just $2.8 in 2021 and $2.2 in 2020. The latest high-level visits, including by U.S. State Secretary Antony Blinken and President Kassym-Jomart Tokayev’s visit to New York in September 2022, where he met with top American executives, are expected to bring trade and investments with American partners up.

Switzerland closes the top three of foreign investors in Kazakhstan, with $2.6 billion of investments in nine months of 2022. In 2021, they hit $2.7 billion.

These three countries account for $59.6 percent of all FDI in Kazakhstan.

What regions are most attractive to foreign investors?

According to the data, Atyrau region remains the most attractive region for foreign investors. Atyrau is a major oil-producing region in Kazakhstan and has attracted many foreign oil and gas companies. The region is strategically located near the Caspian Sea and has a well-developed transportation system.

In nine months of 2022, it received $7.5 billion of foreign investments in 2022, or one-third of all FDI. Out of $7.5 billion, 93 percent, or $6.9 billion were directed to the mining sector. The pandemic has significantly affected the flow of investments in the region, down from record highest (in the past ten years) $10.5 billion in 2019 to just $5.5 billion in 2020.

Almaty, being the country’s largest city and the financial capital of Kazakhstan, received $5.9 billion in FDI in 2022. The city has a well-developed infrastructure, including an international airport and a modern transportation system and is home to many foreign companies.

East Kazakhstan, third largest recipient of FDI in Kazakhstan in terms of region, received $2.1 billion in 2022. The region is rich in natural resources such as oil, gas, minerals, and timber.

What measures of support does the government provide to foreign investors?

Despite the challenges posed by the COVID-19 pandemic and the geopolitical developments between Russia and Ukraine, Kazakhstan's government remains committed to attracting foreign investment.

Besides efforts to create a favorable business environment, including simplifying regulations, reducing bureaucracy, and improving transparency, Kazakhstan has also launched a number of initiatives to support foreign investment in the country. These include tax incentives, streamlined procedures for obtaining permits and licenses, and support for technology transfer and innovation.

There are 13 special economic zones nationwide, with zero percent corporate income tax, substitution tax, customs duties and VAT on import of goods to special economic zones, and property tax.

24 industrial zones provide availability of ready-made infrastructure, long-term lease agreements and repayment schedules based on land value, absence of industry limitations, and possibility to conclude investment contracts.

Strategic investment agreement is also new mechanism to support investors, adopted in 2021. Commenting on how the new mechanism works, Managing Director of Kazakh Invest national company, in charge of attracting investments and supporting investors, said it is designed to provide state support to investor activity through the provision of investment preferences, including tax incentives. This document implies individual distribution of the types of investment preferences, conditions and procedure of their provision.

«At the same time, the Tax Code of Kazakhstan stipulates conditions for the application of strategic agreement Thus, according to the Tax Code, it may provide for the following tax preferences for the investor - reduction of corporate income tax by 100 percent, application of 0 coefficient when calculating land tax, application of 0 coefficient when calculating property tax and exemption from value-added tax (VAT) when carrying out activities in a special economic zones,» said Kozhanov in an interview for this article.

The agreement is concluded between the government of Kazakhstan and the legal entity and provides for the stability of legislation for a period of 25 years, with a special focus on the norms of tax and labor legislation. However, to become eligible for this type of support, an investor should make an investment of not less than $51 million.

So far, only two such strategic agreements were signed. The latest was with Hyrasia One company that operates the construction of a green hydrogen plant in the Mangystau Region. The company is a subsidiary of SVEVIND Energy Group, a European project developer with more than 30 years of experience in the renewable energy sector. The project’s cost is $50 billion.

The list of strategic investment projects eligible for strategic agreement consists of 70 projects worth more than $13 billion.

«In terms of countries on the list, projects are being worked out with investors from around 15 countries, including the Netherlands, Türkiye, the Russian Federation, the United States, Great Britain. It is planned that after the adoption of the new regulations, 24 applications will be sent to the government of Kazakhstan for consideration to conclude the agreement,» said Kozhanov.

Impact of geopolitical development on foreign investment flow in Kazakhstan

Kozhanov said Kazakhstan, like many countries around the world, had to face the consequences from what has been going on between Ukraine and Russia.

«Geopolitical changes have affected not only Kazakhstan, but also the whole world. On the one hand it is of course a challenge, as the preconditions for economic instability have been artificially created, but at the same time opportunities have emerged,» he said.

By opportunities, Kozhanov meant the relocation of offices of foreign companies to Kazakhstan. To date, there are more than 400 companies from nearly 40 countries which have announced their withdrawal from the Russian market or have suspended their investment activities.

Фото: shutterstock.com

Фото: shutterstock.com

«Close work is being carried out with 62 companies, and 24 of them have completed the process of relocation. Seventeen companies are working on this opportunity, and 21 more may be re-located in the future. The main sectors are processing and food industry, IT, metallurgy, machine building,» said Kozhanov.

However, not all companies are ready to speak publicly about their relocation plans, as many are public.

«But we can say that companies in the mining and metallurgy sector have become more active. Large companies are exploring the possibility of implementing projects in the field of mining and downstream processing. Work is being carried out on large deposits, previously considered difficult and capital-intensive projects,» said Kozhanov.

Kazakh Invest also acknowledges an increased interest from investors in agriculture projects, not a surprising trend, giving the fact that amid the geopolitical tensions, food security becomes of paramount importance.

Challenges

Rysmambetov questions the use of the term «attraction of investments.» He finds it more rational to work to create a favorable investment climate and most importantly, ensuring that Kazakh citizens are eager to invest in their country in the first place.

«I have told the Iranians, the South Koreans, the Germans many times, come and see us. They say we have a lot of interesting things, but why don't your investors invest? As long as we are not interesting to ourselves as a market, we will not be interesting to others. If we focus on foreign investors, we will be fulfilling someone else's plans, not our own. This does not mean that we should only emphasize domestic ones, but the domestic investor is very important. China, South Korea, Japan, and other countries are dominated by their own domestic investors,» said the expert.

He believes the measures to increase the protection of property rights and de-monopolization efforts will contribute to bringing more investments to the country.

«We still have at least three years of work before we have a good investment climate. A good indicator is that Standard and Poor's has updated its outlook to stable instead of negative for our country and we have become more interesting to outside investors,» he said.

The new government in Kazakhstan headed by Alikhan Smailov, re-elected just yesterday, will have a wide range of issues to address. Turning the challenging geopolitical circumstances into an opportunity will be one of them, with investments making a real contribution to the economic growth, tasked to reach at least 4 percent annually.