What is IPO and why it is important for Kazakhstan?

What is IPO?

IPO, which stands for the initial public offering, is a process whereby a privately owned company lists its shares on the stock exchange to make them available to the public. It is a very first sale of a stock issued by a company on the public market.

Going public is a difficult and time-consuming process. Despite what many might think that it is just about the shares being listed with high returns, that is actually not the case. IPO is in fact a very risky undertaking.

Because of this, a private company that intends to go public usually employs an underwriter—typically an investment bank—to provide advice on the IPO and aid in the determination of the offering's starting price and the number of shares as well as the time needed to go public, During roadshows, underwriters meet with potential investors to help management get ready for an IPO.

«The underwriter puts together a syndicate of investment banking firms to ensure widespread distribution of the new IPO shares,» says Robert R. Johnson, Ph.D., chartered financial analyst (CFA) and professor of finance at the Heider College of Business at Creighton University, as quoted by Forbes magazine. «Each investment banking firm in the syndicate will be responsible for distributing a portion of the shares.»

Going public raises significant cash for a company which allows it to scale and grow. There are equally many companies that decide to stay private.

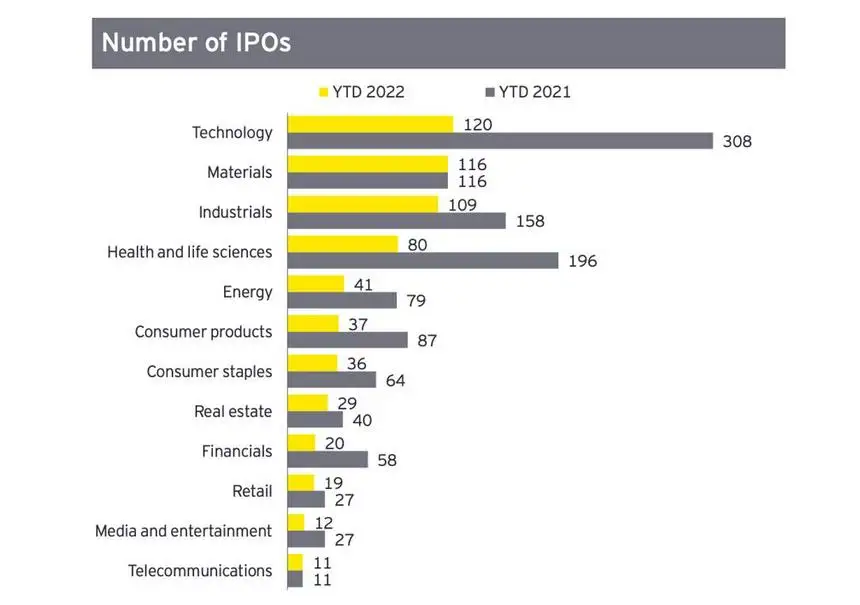

The number of companies undertaking IPO is always fluctuating due to various factors. If the first three quarters of 2021 were quite busy for companies that had to postpone their IPO plans due to the COVID-19 pandemic, the year of 2022 was not an easy one as well with the geopolitical tensions, market volatility, and rising inflation hindering the plans again.

In the second quarter of 2022, the worldwide IPO market featured 305 deals, raising US$40.6 billion in proceeds, according to EY data, a decline of 54 percent and 65 percent, respectively, year-over-year (YOY). There were 630 IPOs in total in 2022 as of June raising US$95.4 billion in proceeds, which represents a decline of 46 percent and 58 percent in terms of amounts raised.

«Any initial momentum carried from a record IPO year of 2021 was quickly lost in the face of

increasing market volatility from rising geopolitical tensions, unfavorable macroeconomic

factors, weakening stock market/valuation and disappointing post-IPO performance, which

further deterred IPO investor sentiment. With tightening market liquidity, investors have

become more selective and are refocusing on companies that demonstrate resilient business

models and profitable growth, while embedding ESG [environment, social and governance] as part of their core business values,» said Paul Go, EY Global IPO Leader.

In terms of regions, the Asia-Pacific region reported 181 IPOs, raising US$23.3 billion in proceeds in the second quarter of 2022, a decline of 37 percent for volume and 42 percent in proceeds. 41 deals were reported in the Americas region, raising US$2.5 billion in proceeds, which is 73 percent lower in the number of deals and 95 percent less in proceeds year over year. As for Europe, the Middle East and Africa region, there were 83 deals that raised US$14.8 billion in proceeds, a year-over-year decline of 62 percent and 44 percent, respectively.

In terms of sectors, the technology sector continued to lead by number, whereas energy has overtaken to lead by the volume of proceeds. Experts forecast the technology sector will continue to be prevalent. At the same time, as renewables take center stage, the energy sector is expected to continue to lead by proceeds from bigger deals.

Privatization efforts in Kazakhstan

Privatization efforts in Kazakhstan might not be large-scale, but it has made a significant push to reduce the share of the state in the economy by listing shares of national companies on the stock exchange.

The country had its large-scale privatization plan for 2016-2020 which was executed in full. The new plan for 2021-2025 includes 721 state enterprises. By the end of 2021, it was 35 percent fulfilled. The share of the state in the economy has been reduced to 14.6 percent.

Though the privatization program has continued since 2015, the major IPO took place in November 2018, when Kazatomprom national company which operates the country’s massive uranium reserves and is one of the world’s largest uranium producers became the first large Kazakh company to list an IPO. It offered 15 percent equity on the London Stock Exchange (LSE) and the Astana International Exchange (AIX), raising $451 million.

Addressing the meeting with businesses in January, President Kassym-Jomart Tokayev said reducing the share of the state in the economy is one of the key goals of the new economic model.

«It is necessary to take radical measures to reform the so-called quasi-state sector. As of today, it is nearly 6,500 organizations. It is necessary to reconsider the grounds and conditions of the state participation in business towards its reduction,» said Tokayev.

There are several important principles in the privatization process, according to Tokayev. The first is that privatization should exclude the emergence of private monopolists. Secondly, the sale of assets into private hands should help reduce the burden on the budget, and third, privatization should have a concrete economic return.

The role of the Samruk Kazyna National Wealth Fund which owns almost all national companies is important. Its assets amount to nearly $69 billion.

In the privatization plan for the next five years, 25 companies belong to the fund, including five assets that were privatized and 20 that are in the process of pre-sale preparation. Among those 25 companies, 8 are major assets - KazMunayGas (KMG) oil and gas company, Air Astana airline, QazaqGaz operating the country’s gas reserves and pipelines, Tau-Ken Samruk which is focused on the development of gold, copper, and lead-zinc deposits, Qazaq Air airline, Kazpost national post operator, Kazakhstan Temir Zholy national railways company and Samruk-Energy electricity generating company.

«We have an important task– to bring KMG to the IPO by the end of this year. The IPO of KMG is planned on the local AIX and KASE exchanges also with access for international investors. In general, I would like to note that regardless of the date of the portfolio companies’ IPO, each of them needs to ensure compliance with listing requirements in terms of corporate governance, reporting in the time agreed with shareholders,» said Samruk Kazyna Chair Almassadam Satkaliyev.

According to KMG Deputy CEO Dauren Karabayev, the allocation of shares will be carried out once the book building (the book-building process of IPO is a price discovery mechanism to ascertain demand and determine share prices) is completed, based on the recommendations of investment banks and discussions between KMG and the selling shareholders.

«In the distribution, priority is planned to be given to retail investors, considering the balance of interests of all stakeholders. KMG and Samruk Kazyna are interested in forming a high-quality, diversified investor base and are aimed at a long-term presence on the fast-growing Kazakhstan stock market,» said Karabayev.

All citizens of Kazakhstan should be able to buy shares of national companies, according to President Tokayev. This is important in forming the investment culture among the population.

«Ordinary citizens of our country should be able to buy shares in national companies and receive their dividends on investments. This way the investment culture of the population is formed. We must make IPOs accessible to all citizens of Kazakhstan,» said Tokayev addressing the AIFC (Astana International Financial Centre) Board of Management meeting on June 27.

But this will require new digital solutions, eliminating paperwork and bureaucracy.

Written by Assel Satubaldina