Strategic significance of Trans-Caspian International Transport Route for Kazakhstan: opportunities, challenges, and road ahead

In recent years, the Trans-Caspian International Transport Route (TITR), also known as the Middle Corridor, has been gauging increased attention in Kazakhstan and among other stakeholders. As countries began to seek diversification of routes due to geopolitical developments, the corridor became a viable alternative option, offering opportunities yet formidable challenges. In this analytical article, Kazinform News Agency delves into the strategic significance of the corridor for Kazakhstan and the opportunities and challenges moving forward.

WhatisTITR

TITR is a strategic transportation network designed to facilitate the movement of goods between Asia and Europe. This route leverages a combination of rail, road, and maritime transport across several countries, including Kazakhstan, Azerbaijan, Georgia, and Türkiye, extending into European destinations.

Countries where the route passes and international partners are increasingly working together to unlock economic potential and forge new links in the chain of global commerce.

For Kazakhstan, a nation straddling the heart of Eurasia, the TITR offers a unique opportunity to catalyze its development, positioning it as a critical hub in the international logistics network. This aligns with the task set by President Kassym-Jomart Tokayev to turn Kazakhstan into a full-fledged logistics power and a transport and logistics hub of Eurasia.

“Realizing the full potential of transport and logistics is of strategic importance. We are witnessing the emergence of a new global economic geography. Trade flows from China to Europe, Russia, Central Asia, and back are expected to grow rapidly,” said President Tokayev in the address to the nation in September 2023.

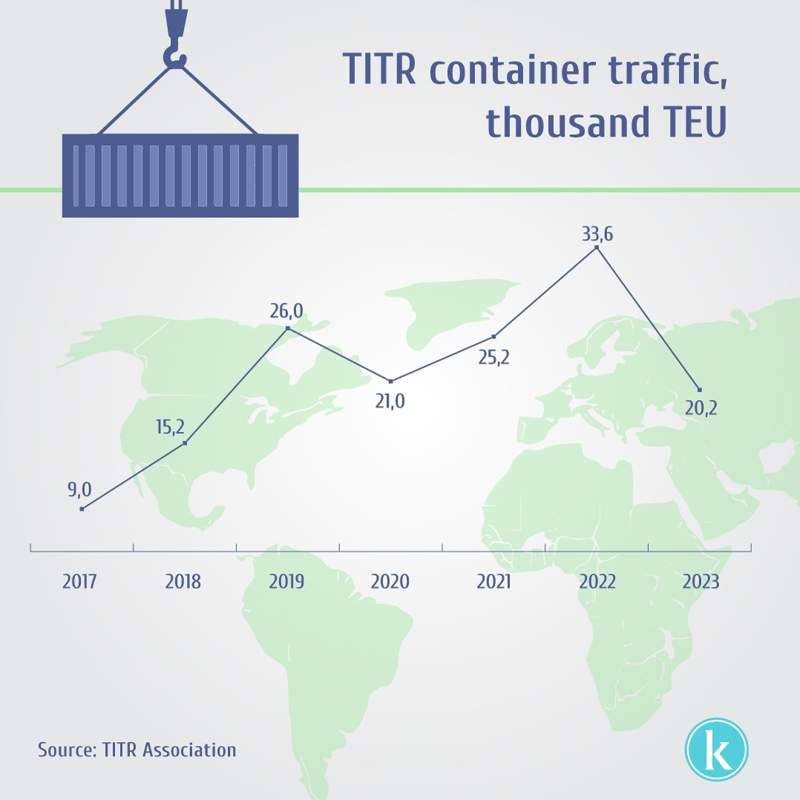

According to the Ministry of Transport, the volume of shipments along this corridor has increased by 65 percent compared to 2022 and amounted to 2.76 million tons.

In 2023, oil was transported along the route for the first time as part of broader efforts aimed at the diversification of oil supplies. In line with President Tokayev’s task to increase the volume of oil transportation along the Trans-Caspian corridor, KazMunayGas and Azerbaijan’s state oil company SOCAR signed an agreement envisioning the transportation of up to 1.5 million tons of oil per year from the Tengiz field in the direction of the Baku-Tbilisi-Ceyhan oil pipeline.

In 2023, its volume reached 1 million tons and Kazakhstan plans to increase it to 3 million tons in the next 2 years.

“The Trans-Caspian route will play an important role in strengthening our transit potential. In the medium term, the volume of transportation along this corridor could increase fivefold. To accomplish this, coordinated efforts with partner countries—China, Azerbaijan, Georgia, and Türkiye—are necessary,” said Tokayev back then.

In 2022, Kazakhstan, Azerbaijan and Georgia signed a roadmap for the simultaneous elimination of bottlenecks and the development of the Middle Corridor until 2027, which provides for agreed principles of work, as well as specific projects with precise parameters, deadlines and responsible performers.

Opportunities are, therefore, ample both for Kazakhstan and other participating states. By capitalizing on its strategic position and actively investing in the expansion and modernization of its transport infrastructure, particularly railways and Caspian Sea ports like Aktau and Kuryk, Kazakhstan can solidify its role as a central pillar in the Eurasian trade architecture.

By 2027, it intends to increase the throughput capacity to 10 million tons per year, cut delivery times up to 14-18 days, including to 5 days via Kazakhstan.

Bottlenecks for Kazakhstan

The European Bank for Reconstruction and Development (EBRD) published a study in 2023 that aimed to identify the sustainable transport connections between Europe and Central Asia, the Middle Corridor was named the most viable and sustainable option.

“Kazakhstan has invested heavily in restoring and developing its transport infrastructure, linking almost all available routes and making the country’s international transport corridors more attractive than those of its regional peers. In addition, with the rapid economic development of China, eastern Europe and Southeast Asia, transit traffic through Kazakhstan is projected to increase significantly over the coming decades. 85 percent of transit containers along the three Eurasian transport corridors pass through Kazakhstan,” says the report.

Despite its potential, the TITR is not without its challenges. Infrastructure bottlenecks, particularly at cross-border points and in port capacities, pose significant hurdles to seamless cargo movement. Regulatory discrepancies and bureaucratic inefficiencies across the countries along the route impede the flow of goods, underscoring the need for harmonized policies and streamlined customs procedures.

The report estimates that 18 billion euros in investment is needed to develop the route.

It also proposes seven soft connectivity measures and 33 hard infrastructure investment needs.

“These investment needs to relate to railway and road network rehabilitation and modernization, rolling stock expansion, port capacity enhancements, improvements to border crossing points, and multimodal logistics centers and auxiliary network connections in all of the five countries involved,” reads the study.

Under the current scenario, transit container volume could increase from 18,000 20-foot equivalent units (TEUs) in 2022 to 130,000 TEUs in 2040. But if all investment needs are realized, the potential is to reach 865,000 TEUs by 2040.

Regarding Kazakhstan, in the short term, five key infrastructure investment priorities have been pinpointed - the construction of the Shalkar-Beineu road between Kyzylorda and Aktau, the bypass project for the Almaty railway station, which is designed to cut down on travel time for shipments and alleviate 40% of cargo traffic at Almaty station, the Darbaza-Maktaaral railway.

Recommendations also include the expansion of the Saryagash railway station by adding four new tracks, each approximately 1,500 meters long, to the existing eight lanes and the expansion of the Altynkol terminal at the Khorgos Gateway.

Among soft measures are the digitalization of transport documents, increased interoperability, and enhanced public-private partnership framework.

At the Investors Forum for European Union - Central Asia Connectivity in January in Brussels, the EBRD pledged to allocate up to 1.5 billion euros on TITR-related projects in the next 2-3 years.

The EBRD and the Kazakh Ministry of Transport also signed a memorandum of understanding, under which the sides will work together on strategic initiatives in road, rail, port and logistics infrastructure to develop the TITR.

Insights from the World Bank

The World Bank also published a study in November 2023, saying it is an “opportune moment” to develop the Middle Corridor. It says that if investments and policies are made right, trade volumes along the Middle Corridor could triple while travel time can halve by 2030.

“Our new data confirms that the Middle Corridor is not only viable but can also become essential to the economies of countries along the route,” said Antonella Bassani, the World Bank’s Vice President for Europe and Central Asia.

“Azerbaijan, Georgia, and Kazakhstan, together with other countries, have made considerable progress in aligning their vision and moving this corridor forward,” she said, emphasizing the World Bank’s readiness to support the Middle Corridor.

According to the report, trade from Kazakhstan, Georgia, and Azerbaijan accounted for nearly two-thirds of flows along the corridor in 2021.

While there are still challenges in terms of the poor capacity of the corridor to handle the growing trade volumes, the World Bank says the corridor entails opportunities and the potential to “transform from a transit trunk line to an ecosystem with a central artery and transport capillaries, where different network segments can unlock new demand and orientation to a variety of flows.”

Prospects

Florian Scheuring, an Assistant Professor of Business Management at the Heriot-Watt University's School of Social Sciences, said the Middle Corridor “appears to be significantly limited regarding its competitiveness.”

“In its current state, the Middle Corridor appears not capable of competing at cost, reliability or speed of transportation. In consequence, utilization of the Middle Corridor might be more closely linked to shortfalls of transportation capacity among alternate routes or be associated with trade among countries within the immediate corridor rather than between the start and end points of the entire corridor. At its core, the problems appear to be cost, reliability, and speed,” he said.

Speaking of Kazakhstan’s role, he said the Central Asian nation, which accounts for a significant majority of cargo volumes originating from the corridor, should adopt a strategy that capitalizes on its strengths in cargo volume and expected growth over the coming ten years. At the same time, he stressed the importance of recognizing that each participant in a corridor, trade route, or supply chain relies on the others in these networks.

“In the first instance, from a corridor perspective, it would be integral to identify where the lack of reliability and adverse impacts on the speed of the corridor stem from. Addressing these issues should be the immediate focus as it will strengthen and facilitate cargo flows within the Middle Corridor even if it does not immediately translate into greater volumes between China and Europe,” he said.

Scheuring expects the demand and attention to TITR will continue to grow.

Looking ahead, the strategic imperatives for capitalizing on the TITR are clear. Yet, the ultimate success of the TITR hinges on effective collaboration and coordination among all participating countries. Regular dialogue and collaborative efforts in infrastructure development will be crucial for overcoming potential challenges and maximizing the long-term benefits of the TITR for all stakeholders involved.